Dollar Dog Club

If your child is age 12 or under, the Dollar Dog Club is a fun way to teach kids how to save money. It teaches them that when they save money now, they will be rewarded in the future.

From the minute your child is born until the day before their 13th birthday, they can be a part of the Dollar Dog Kids Club! Just sign your child up for a TrueCore membership and open a savings account. This can be done at any of our locations. All you will need to provide is two forms of identification and your child's social security card.

For every $25 put in to the Dollar Dog Kids Club account, the child will receive a Dollar Dog stamp. The more money the child saves, the more stamps they will earn to trade in for rewards.

10 Stamps = One (1) $5.00 Dairy Queen® Gift Card or One (1) $5.00 AMC Movie Gift Card

Money 101 Club

If you're age 13 to 17, you can be a part of the Money 101 Club! If you're already a TrueCore member, you'll be automatically enrolled in the Money 101 Club on your 13th birthday. If you're not a TrueCore member yet, simply sign up for membership by opening a savings account. This can be done at any of our locations. All you will need to provide is your social security card. The Money 101 Club will give you access to:

Did you know that you can earn prizes every time you save money at TrueCore?

Every time you deposit $25.00 into your Money 101 savings account, you'll earn a stamp. Ten stamps will earn your choice of: One (1) $5.00 Dairy Queen® Gift Card or one (1) $5.00 AMC Movie Gift Card.

Dollar Dog and Money 101 Club Certificate Rates

| Term |

Minimum |

Rate |

APY* |

| 12 Months |

$250 |

1.243% |

1.25% |

Smart Start Checking Rates (ages 13-17)

| Minimum |

Rate |

APY** |

| N/A |

3.445% |

3.500% |

For complete details, call or text a Member Service Representative at 740-345-6608.

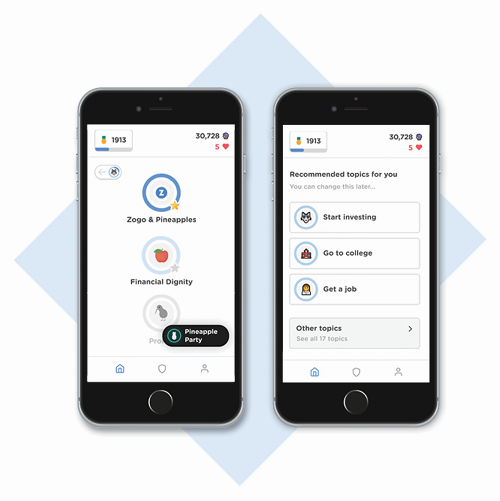

Zogo

It pays to learn about finance - literally.

Zogo is a gamified financial literacy app that rewards users for completing bite-sized financial literacy lessons on intelligently saving, spending and managing their money. The free app includes nearly 300 modules in 20 different topics, from opening a bank account to saving for retirement - and everything in-between.

By completing modules, taking interactive five-question quizzes and participating in daily trivia games, users earn virtual "pineapples" and work toward real-life rewards - like a gift card to one of their favorite stores - Apple, Starbucks, GameStop, AMC, Amazon, and many more!

Learn more about Zogo here.

TrueCore received funding for the Zogo app through a grant from the Ohio Credit Union Foundation.

*All deposits are insured up to $250,000 by the NCUA. APY= Annual Percentage Yield. APY is accurate as of July 16, 2025. APY based on monthly compounding for one year. Rates and terms are subject to change without notice. A penalty applies for early withdrawal, which would reduce earnings on the account. Federally insured by NCUA.

**APY=Annual Percentage Yield. APY is accurate as of September 21, 2023. Checking account rates are adjustable and are subject to change monthly on the 1st of each month. Annual Percentage Yield is based upon monthly compounding for one year. All rates are subject to change without notice. There is no minimum balance required to open the checking account or to obtain the disclosed APY. All deposits are insured up to $250,000 by the NCUA (National Credit Union Administration).